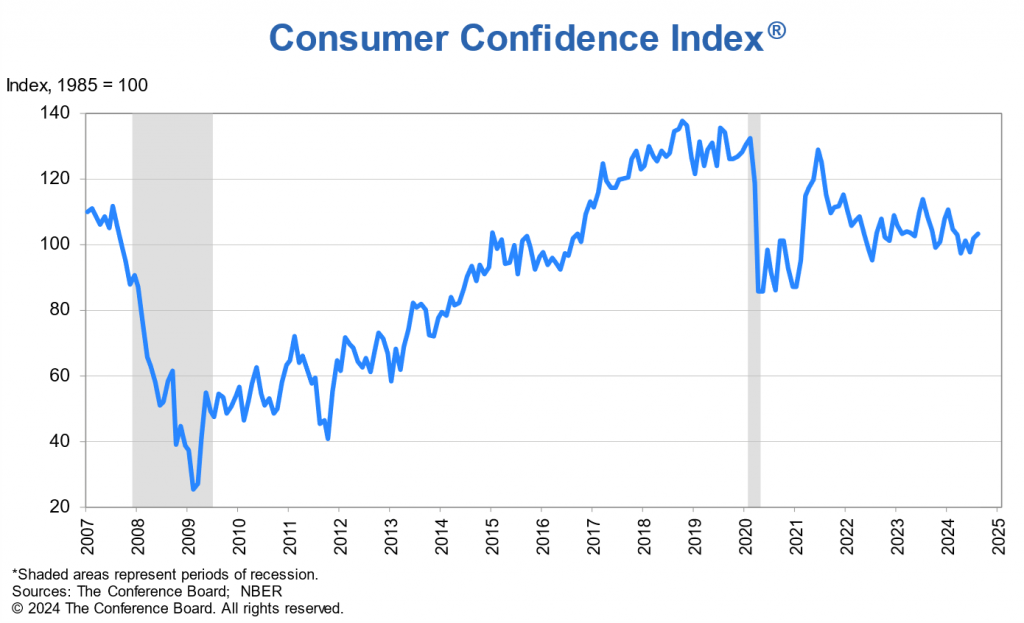

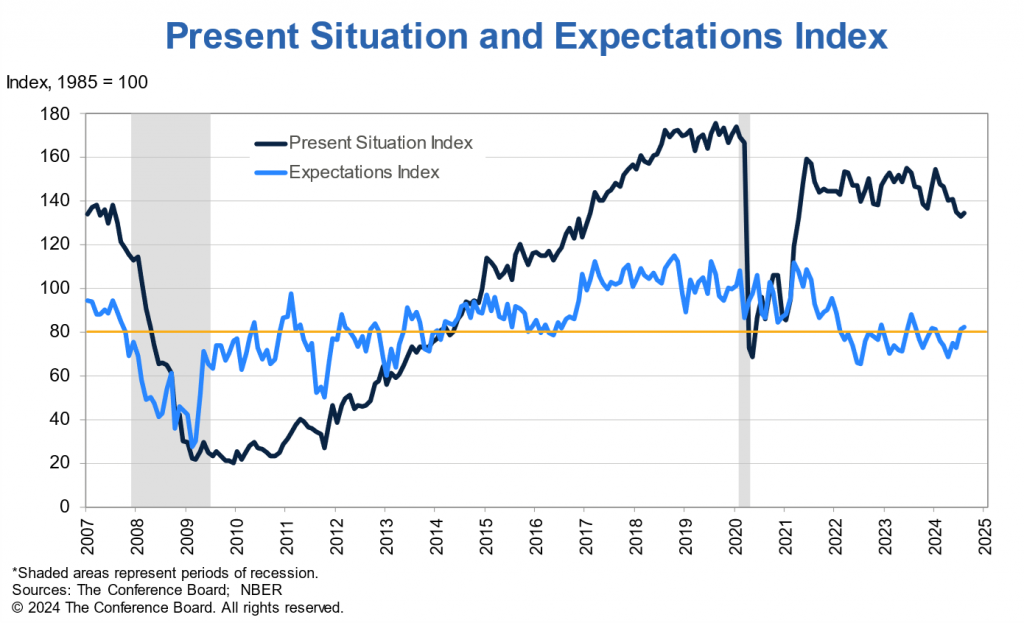

The Conference Board Consumer Confidence Index rose in August to 103.3 (1985=100), from an upwardly revised 101.9 in July. The Present Situation Index—based on consumers’ assessment of current business and labor market conditions—improved to 134.4 from 133.1 in July. The Expectations Index—based on consumers’ short-term outlook for income, business, and labor market conditions—also improved in August to 82.5.

As the Expectations Index for July was revised up to 81.1, August marked the second consecutive month of the Index above 80. (A reading below the threshold of 80 usually signals a recession ahead.) The cutoff date for the preliminary results was August 21, 2024.

“Overall consumer confidence rose in August but remained within the narrow range that has prevailed over the past two years,” said Dana M. Peterson, Chief Economist at The Conference Board. “Consumers continued to express mixed feelings in August. Compared to July, they were more positive about business conditions, both current and future, but also more concerned about the labor market. Consumers’ assessments of the current labor situation, while still positive, continued to weaken, and assessments of the labor market going forward were more pessimistic. This likely reflects the recent increase in unemployment. Consumers were also a bit less positive about future income.”

“In August, confidence declined among consumers under 35 while it increased for those 35 and older. On a six-month moving average basis, confidence remained the highest among young consumers. Despite the overall improvement in the headline Index, confidence declined for consumers earning less than $25K. On a six-month moving average basis, consumers earning over $100K remained the most confident. Confidence among consumers earning $15K to $24.9K continued to trend down and was almost as low as for those earning less than $15K.”

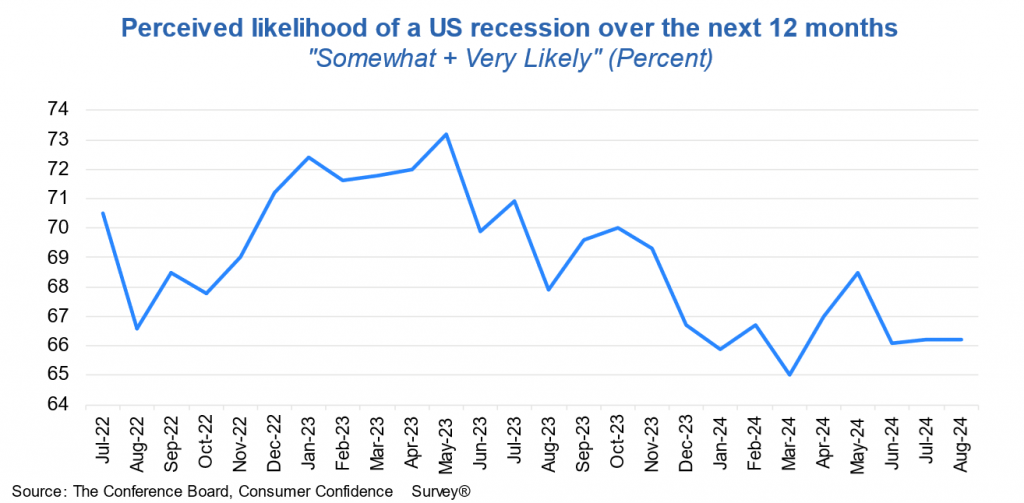

Peterson added: “Consumers were likely rattled by the financial market turmoil in early August, as they were less upbeat about the stock market. In August, 46.9% of consumers expected stock prices to increase over the year ahead (down from 50.6% in July), while 27.2% expected a decrease (up from 23.1%). August’s write-in responses also included more mentions of stock prices and unemployment as affecting consumer’s views of the US economy. However, consumers did not change their views about a possible recession: the proportion of consumers predicting a recession was stable and well below the 2023 peak.”

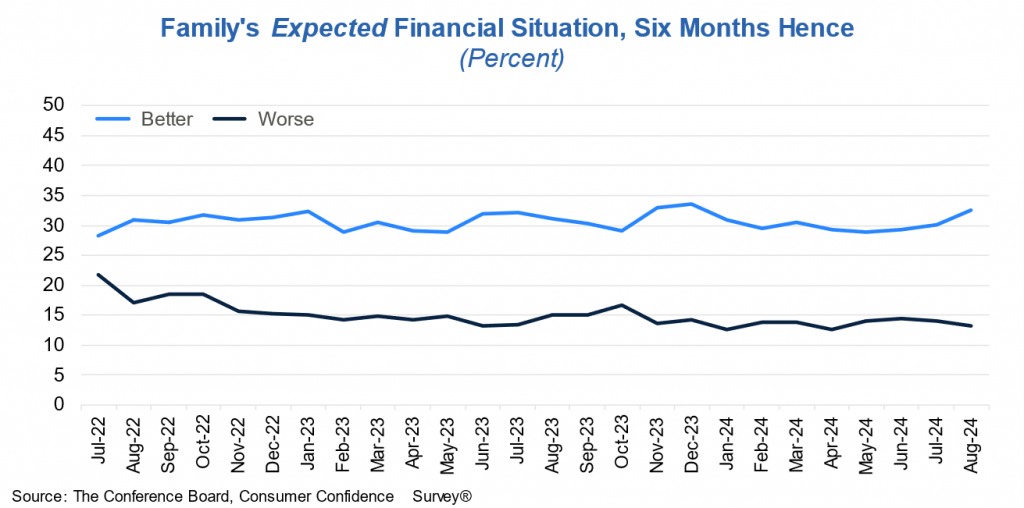

Consumers’ assessments of their Family’s Current Financial Situation were less positive, but consumers were more optimistic for the next six months. (These measures are not included in calculating the Consumer Confidence Index®.)

Average 12-month inflation expectations dropped to 4.9% in August—the lowest since March 2020 and consistent with slower overall inflation and declines in some goods prices. Nonetheless, mentions of prices and inflation topped write-in responses. Meanwhile, the share of consumers expecting higher interest rates over the next 12 months dropped for the third month in a row to 46.5%—the lowest since February 2024. The share expecting lower rates increased to 31.5%, the highest since April 2020.

On a six-month moving average basis, purchasing plans for homes fell to a new 12-year low, while buying plans for cars improved slightly. Buying plans for big-ticket appliances were up on average but the increase was driven by only a few items: refrigerator, TV, and washing machine. Plans to buy a smartphone or laptop/PC in the next six months increased again.

In August write-in responses, the share of respondents believing the 2024 elections would impact the economy was stable, at slightly above 2020 levels—but well below the August 2016 level.

Present Situation

Consumers’ assessments of current business conditions were more positive in August.

- 20.8% of consumers said business conditions were “good,” up from 19.2% in July.

- 17.7% said business conditions were “bad,” down from 18.2%.

But consumers’ appraisals of the labor market deteriorated in August.

- 32.8% of consumers said jobs were “plentiful,” down from 33.4% in July.

- 16.4% of consumers said jobs were “hard to get,” slightly up from 16.3%.

Expectations Six Months Hence

Consumers were more optimistic about the business conditions outlook in August.

- 18.4% of consumers expected business conditions to improve, up from 15.2% in July.

- 15.6% expected business conditions to worsen, down from 16.2%.

Consumers’ assessments of the labor market outlook were slightly less optimistic in August.

- 16.1% of consumers expected more jobs to be available, up from 15.2% in July.

- 17.5% anticipated fewer jobs, also up from 16.4%.

Consumers’ assessments of their income prospects were more pessimistic in August.

- 16.9% of consumers expected their incomes to increase, down from 17.2% in July.

- 12.7% expected their incomes to decrease, up from 11.6%.

Assessment of Family Finances and Recession Risk

- Consumers’ assessment of their Family’s Current Financial Situation weakened further in August.

- However, consumers’ assessments of their Family’s Financial Situation going forward improved.

- Consumers’Perceived Likelihood of a US Recession over the Next 12 Months was virtually unchanged, and well below the 2023 peak.

The monthly Consumer Confidence Survey, based on an online sample, is conducted for The Conference Board by Toluna, a technology company that delivers real-time consumer insights and market research through its innovative technology, expertise, and panel of over 36 million consumers. The cutoff date for the preliminary results was August 21.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs